Since the proposed merger of Linfox Armaguard and Prosegur Australia came before the Australian Competition and Consumer Commission for approval, the importance and relevance of cash as a means of payment has regularly been in the spotlight. The merger process and subsequent well-reported events have highlighted the cost of maintaining cash as a form of payment in Australia. And while cash logistics has been the headline grabber, the cash infrastructure is all susceptible to the same challenges, and is much broader than just cash logistics. The headlines that we have been reading together with ongoing reporting of cash usage levels and speculation around the continuing decline of cash use poses an important question: can the national cash infrastructure fulfil its role, or is it time for an overhaul?

What is the cash infrastructure?

The cash infrastructure in any country typically comprises at a minimum: central bank note printing and initial distribution; bank note processing and holding; cash logistics; bank branch and ‘offsite’ ATMs, and bank branches including both tellers and customer cash devices. Depending on the country and your perspective, it can also include non-bank transaction centres – in Australia this notably includes Australia Post, and even retailer networks, particularly the large supermarket groups.

Is the cash infrastructure broken?

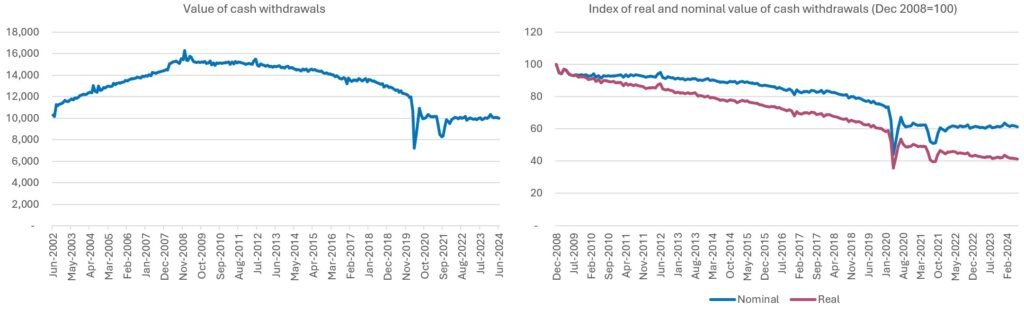

Cash usage in Australia is somewhere between 8% and 18%, depending on the measure and source of information. Regardless of where it sits on that spectrum, two things can be sure: there has been substantial decline in absolute terms from ‘peak cash’ around 16 years ago, and even if nominal cash usage is currently stable, it is still declining in real terms.

There have been two major regulatory changes that have affected the cash infrastructure in the last 25 years: firstly, the effective outsourcing of cash holdings to commercial banks, and secondly the banning of ATM interchange. These two changes meant that the way that cash was held and processed changed, and then that independent ATM networks became more attractive to operators spawning a significant expansion of the national ATM fleet. But outside of these two shifts, the infrastructure has, by and large, remained the same over a period where the underlying product (cash) has had monumental change. Put simply – the national cash infrastructure has not kept up with change, and therefore it is now not fit for purpose. This means there is inappropriate physical infrastructure, duplication in most parts of the infrastructure, and pressure that is both high and increasing around the unit economics of the cash infrastructure.

While every country is different, Australia is not unique. A similar story is playing out in the UK, in the USA, and in New Zealand, to name a few. And in practically every country the ingredients are already in the mix to end up with a broken infrastructure – declining cash usage levels and a capital-intensive, high fixed cost infrastructure.

Is it time for a strategic overhaul?

The question is almost rhetorical – the cash infrastructure is broken, but cash continues to be an important payment instrument for many, even if its use is declining. There have been all sorts of roadblocks to achieving step-change up until now. That said, based on everything we’re seeing in Australia there is industry awareness and motivation to build the cash infrastructure of the future in a way that is fit for purpose and sustainable in a continuing less-cash environment.

What needs to be done?

Australia’s cash infrastructure needs to be right-sized and future-proofed. This requires both short-term tactical measures and long-term strategic planning. The goal should not be to maintain the system as it is but to create an infrastructure that supports cash where it is needed while minimising unnecessary costs. We see five key areas of focus to get the cash infrastructure right:

- Adopt a whole-of-system perspective. Change needs to take a whole-of-system approach, and indeed should consider the broader payments system which has a direct influence on the cash system and cash infrastructure. Decision making up to this point has been isolated to individual entities and operators at every point of the infrastructure, with decisions focused on a narrow and individual set of circumstances, priorities and data. This has contributed to the current predicament and must change.

- Rethinking the wholesale cash system mechanics and cash distribution. Cash distribution includes initial RBA-BDA banknote distribution through to end-point access to cash for consumers and businesses (notably ATM networks). The mechanisms for how cash is held and accessed by consumers have a raft of challenges, ranging from responsibility to funding to access. Despite the recent introduction of the banknote distribution framework approach, the system is largely the same as it was 12 months ago and indeed 16 years ago, and it is not fit for purpose.

- Optimise cash logistics. Cash logistics is one of the highest cost components of the cash infrastructure, and while the amalgamation of Armaguard and Prosegur was intended to resolve some of the efficiency issues, there is still a lot to do. This is not just a problem for CIT operators to solve, as optimisation needs to be at a network level, taking into account all resources available, cash points in the network and activity levels at a cash point, local, and regional level.

- Collaboration at an industry level, including a public-private flavour and regulated pricing models. Extending from the first point, the industry needs to collaborate in a substantive and ongoing manner. The ability to pay with cash is a public good. Firstly, it is important to define who has responsibility for this public good and in what proportion. Then, the practical collaboration model around sharing costs relative to benefits must be defined and implemented. It is highly likely that a regulated price model is needed in some or all areas of the cash infrastructure, in a similar manner to other public good products and services (eg. water, electricity, wholesale telecommunications).

- Legislative support for cash. Finally, at a public policy level strong consideration needs to be given to legislative support for cash. We are seeing this happen in a growing number of jurisdictions across the globe, particularly in Europe and North America. We do not believe that such support is principally to force obligations on businesses. Rather we see that this support would aid a better managed transition of consumer payment behaviours both for consumer choice and for infrastructure management.

Looking Ahead

Australia’s national cash infrastructure is at a crossroads. The declining share of cash payments signals that the system must evolve, but cash’s enduring role in providing payment resilience and financial inclusion cannot be ignored. Now is the time for a strategic overhaul—a plan that right-sizes the infrastructure, makes it more efficient, and ensures that cash remains available where and when it’s needed.

This is not a question of saving an outdated system but of modernising one that still has a vital role to play in Australia’s economy and society. A coordinated, strategic effort to reshape the national cash infrastructure will ensure that Australia is ready to face the future while continuing to support those who rely on cash today.

Questions? Reach out.